Social Security Contribution Cap 2024

Social Security Contribution Cap 2024. After that, their social security obligation is done. So, if you earned more than $160,200 this last year, you.

You aren’t required to pay the social security tax on any income beyond the social security wage base limit. That means the maximum annual contribution is $10,458.

Capital Markets Regulator Sebi On Monday Asked Social Enterprises, Which Have Registered Or Mobilised Funds Through Social Stock Exchange (Sse), To Submit An.

Thus, an individual with wages equal to or larger than $168,600 would contribute $10,453.20 to the oasdi program in 2024, and his or her employer.

The Bulk Of That Came From The Income Taxes Workers Paid, But Seniors Made Their Contribution Too.

The social security administration also announced the 2024 wage cap.

For Earnings In 2024, This Base Is $168,600.

Images References :

Source: www.howtoquick.net

Source: www.howtoquick.net

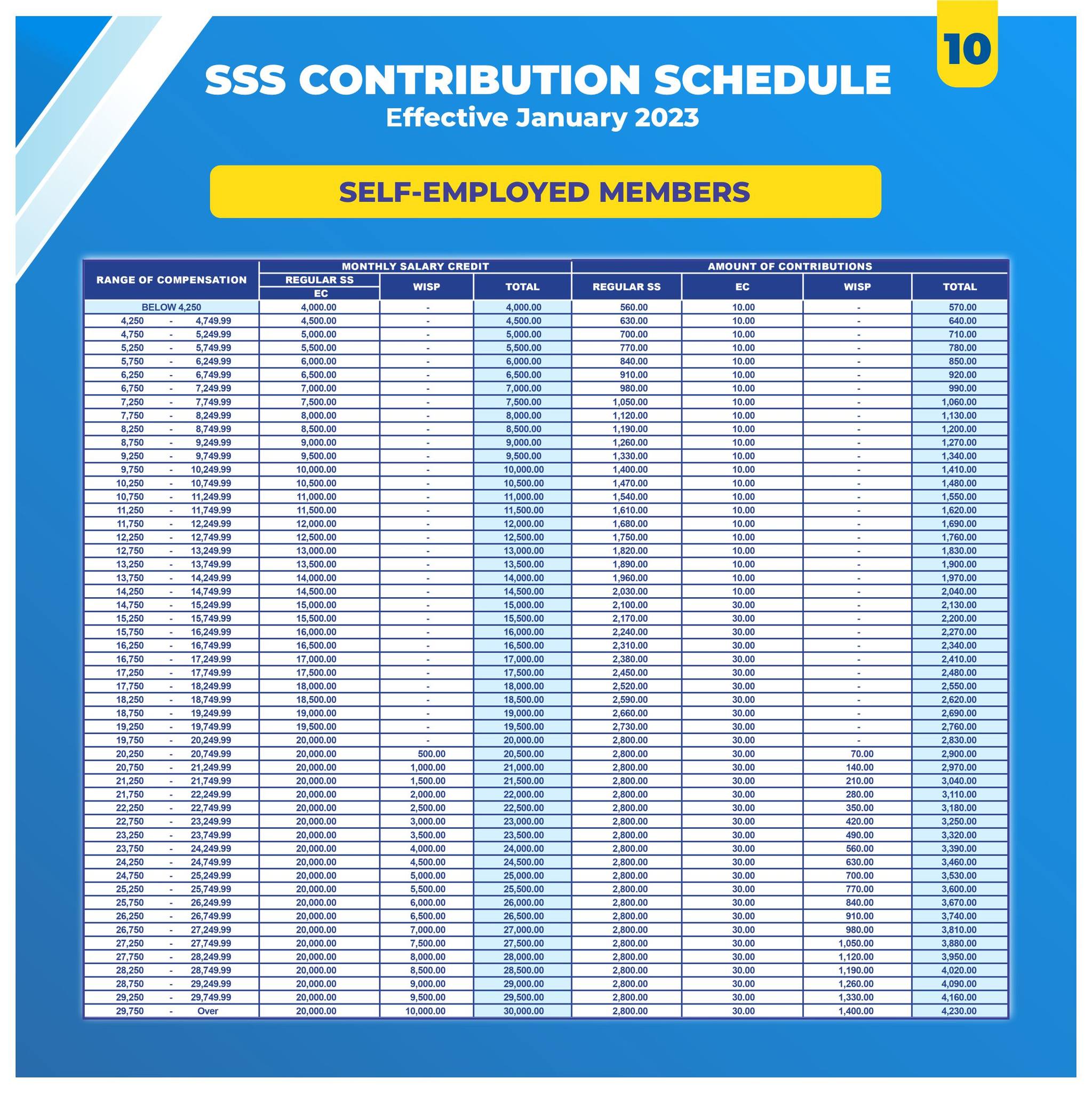

New SSS Contribution Table 2024 Schedule Effective January, You aren’t required to pay the social security tax on any income beyond the social security wage base limit. The social security cap increase for 2024.

Source: www.howtoquick.net

Source: www.howtoquick.net

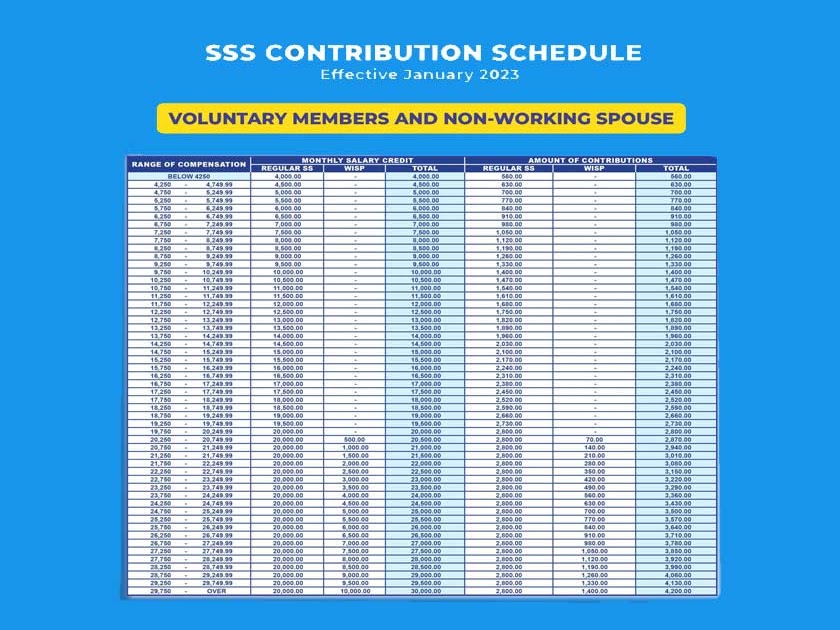

SSS Voluntary Members Contribution Table 2024, The social security administration (ssa) has announced that the maximum earnings subject to the social security payroll tax will increase by $8,400 in 2024. The debate surrounding social security’s sustainability and structure isn’t new.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. Ssa estimates that the 2024 social security wage base will be $167,700.

Source: alviniawjade.pages.dev

Source: alviniawjade.pages.dev

Social Security 2024 Limits Aili Lorine, Internal revenue service figures suggest that 10% of. Refer to what's new in publication 15 for the current wage limit for social security wages.

Source: www.mercer.com

Source: www.mercer.com

2023 Social Security, PBGC amounts and projected covered compensation, Social security took in more than $1.35 trillion in 2023. Refer to what's new in publication 15 for the current wage limit for social security wages.

Source: sommerfotodesign.blogspot.com

Source: sommerfotodesign.blogspot.com

Sss New Contribution Table 2021 The sss basically derives its funds, The table below shows the annual increases in the social security. In 2024, up to $168,600 in earnings are subject to social security payroll taxes.

Source: bipartisanpolicy.org

Source: bipartisanpolicy.org

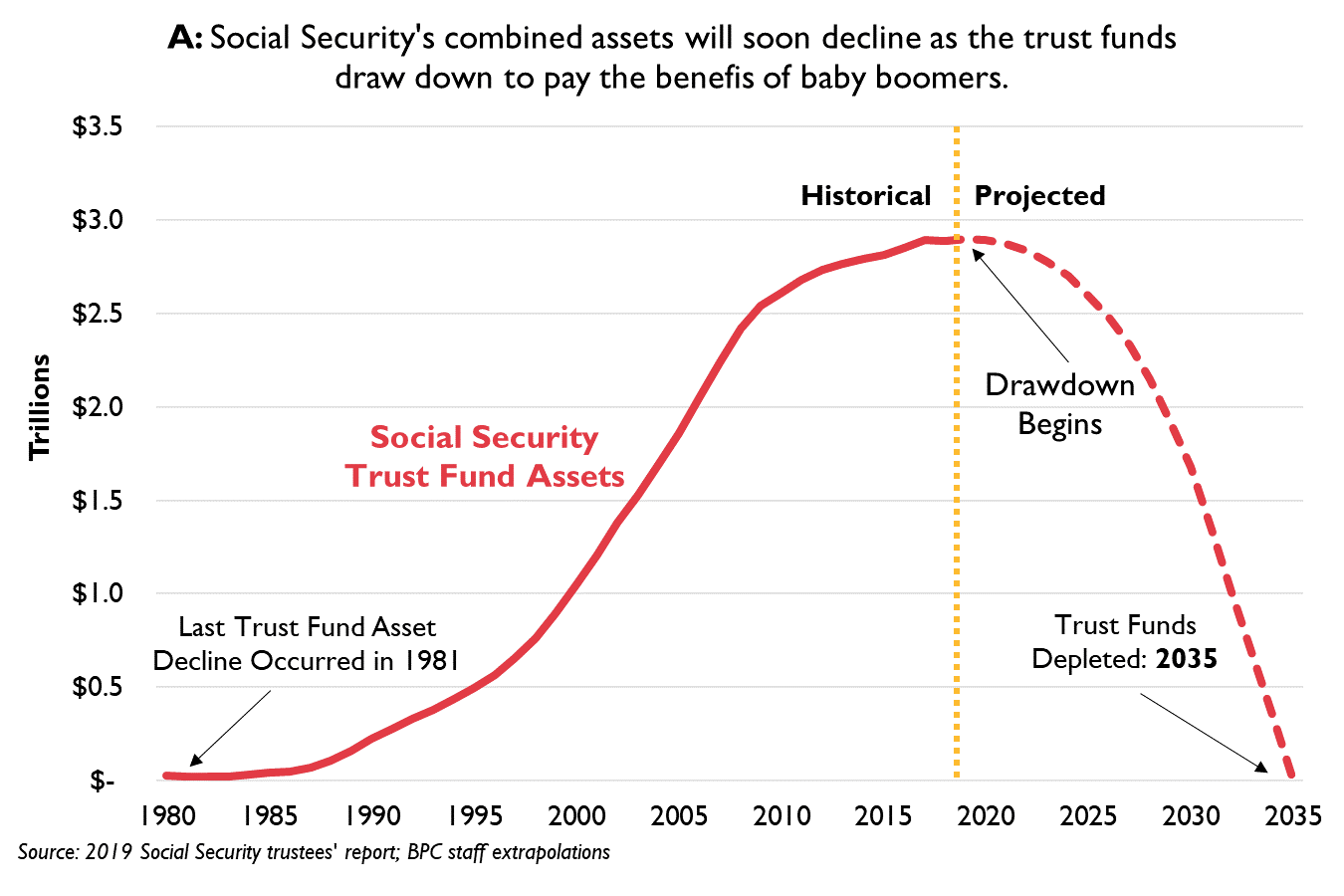

Understanding the New Social Security Projections in Five Charts, Ssa estimates that the 2024 social security wage base will be $167,700. The maximum amount of earnings subject to the social security tax (taxable maximum) will.

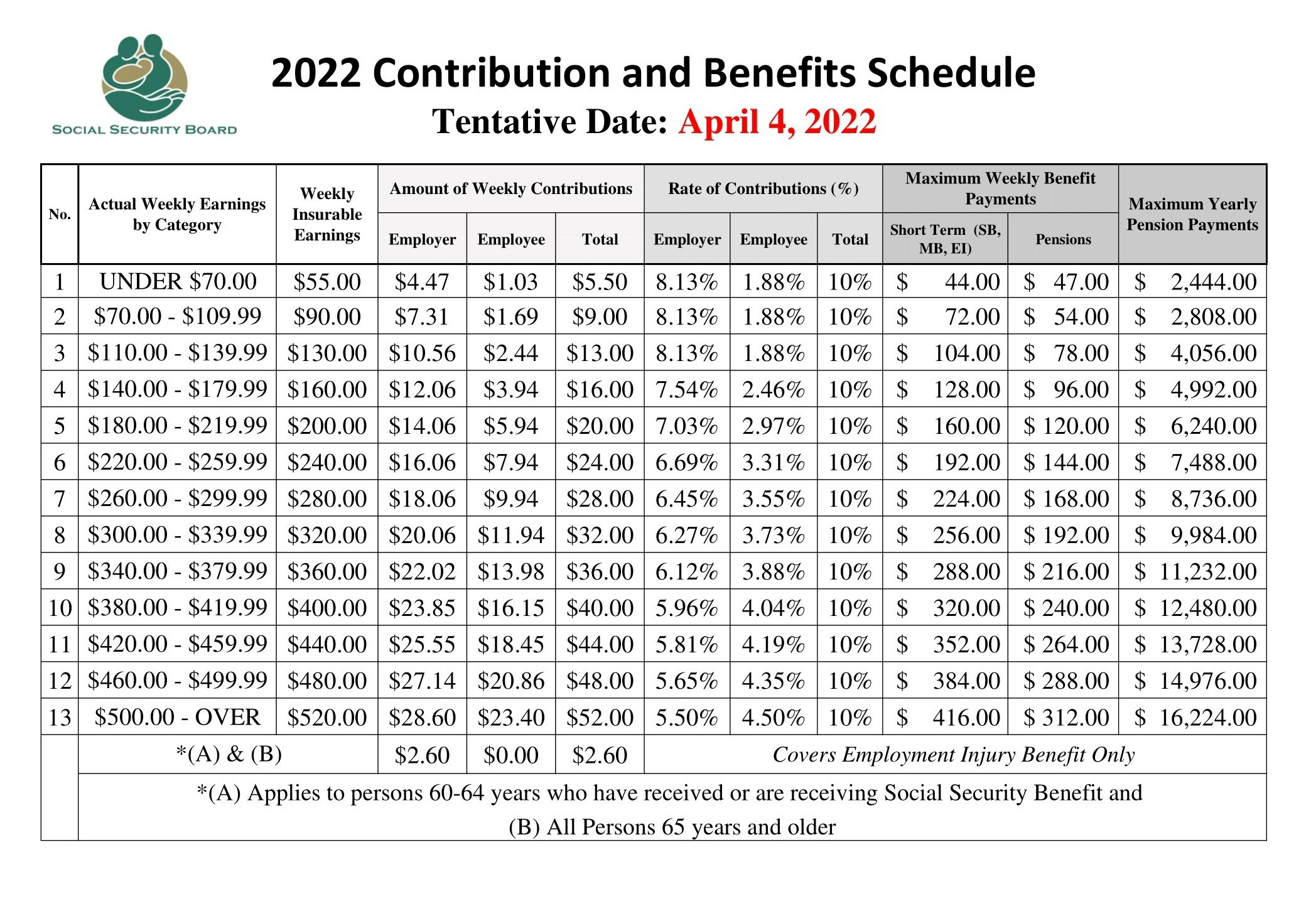

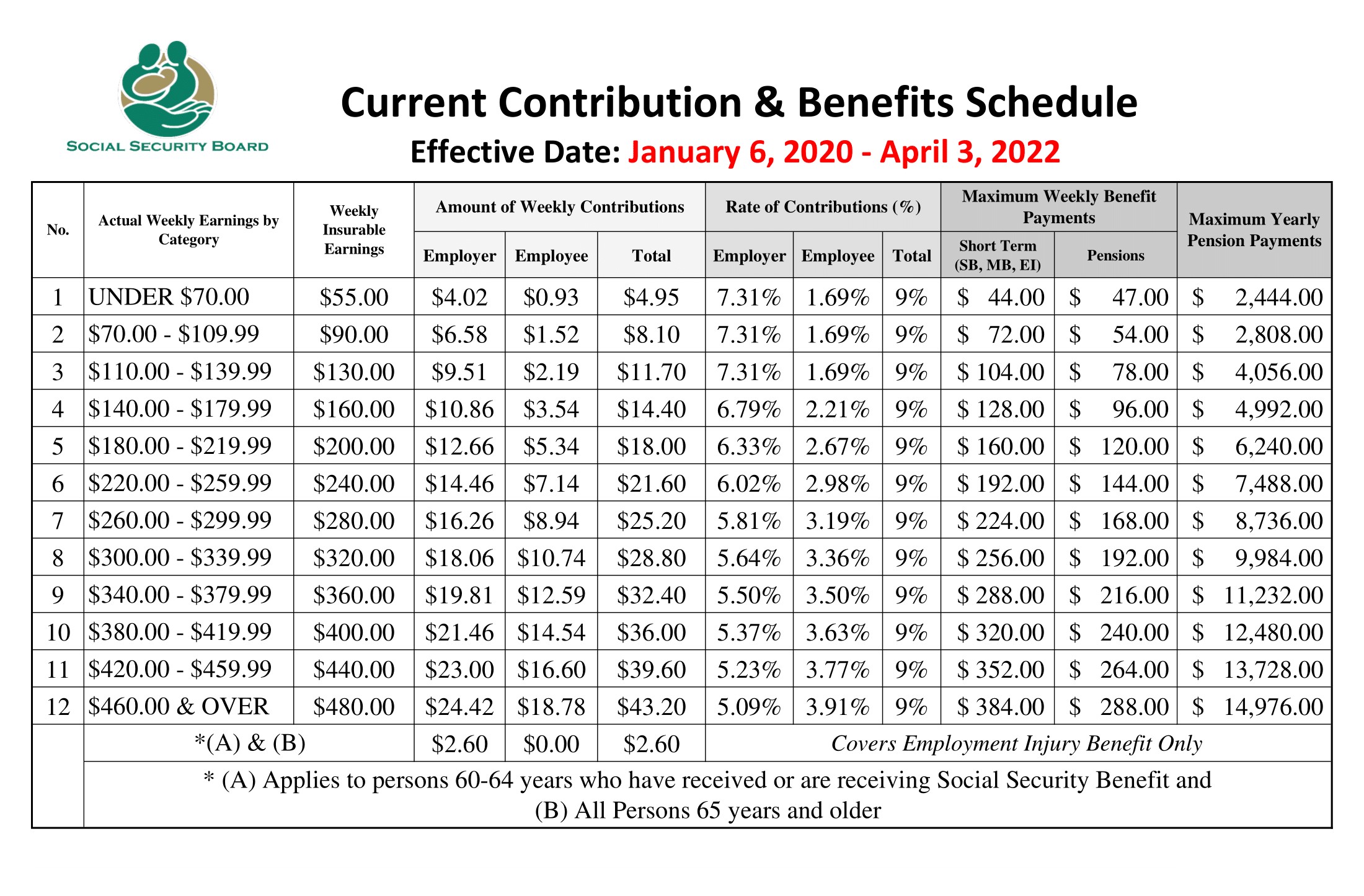

Source: www.socialsecurity.org.bz

Source: www.socialsecurity.org.bz

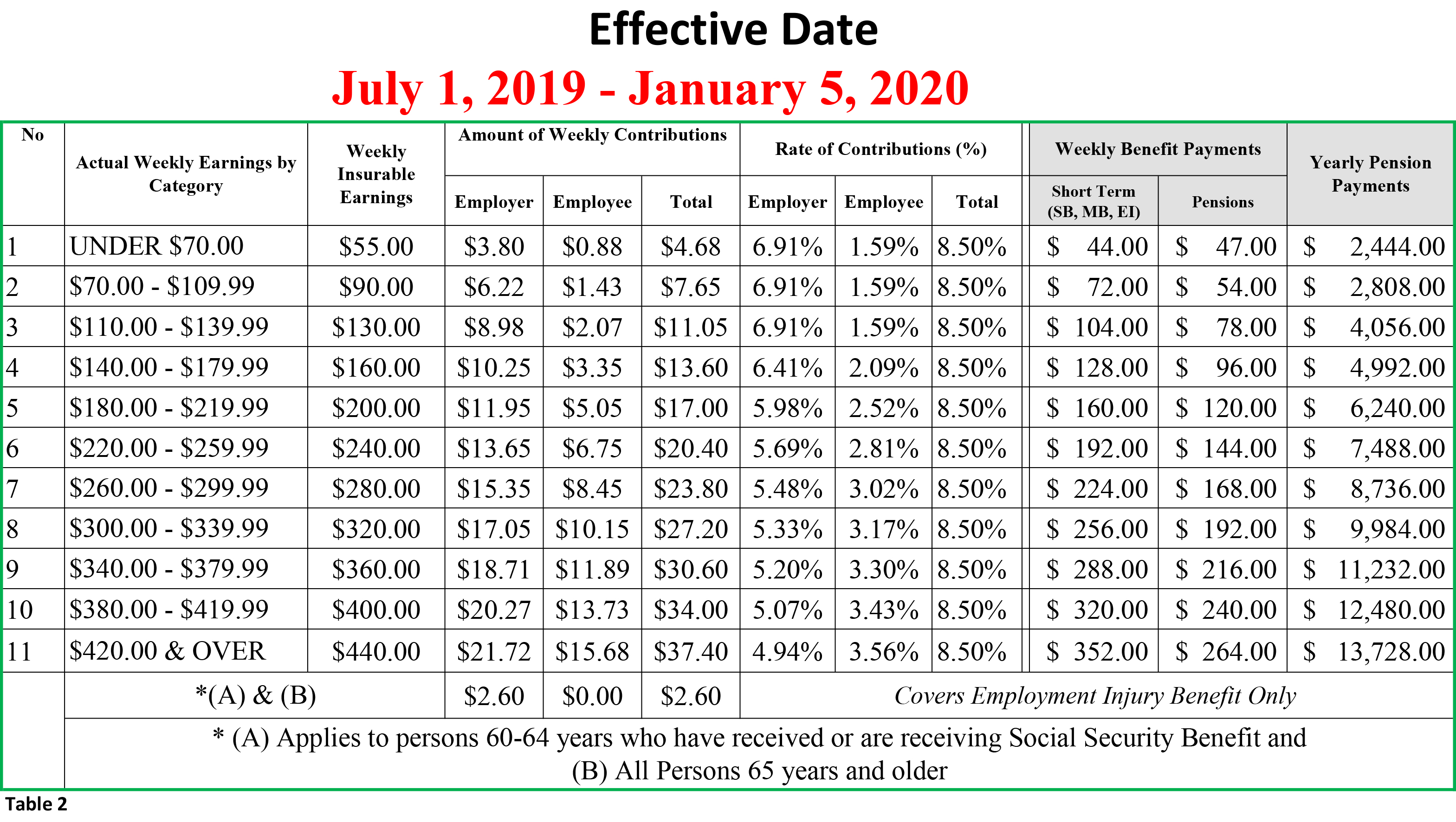

2019 Contribution Reform Social Security Board, Belize, In 2024, that number is $168,600. The debate surrounding social security’s sustainability and structure isn’t new.

Source: mahanakornpartners.com

Source: mahanakornpartners.com

New Rates for Social Security Fund Contributions MPG, The limit is $22,320 in 2024. The commissioner of internal revenue announced the 2024 dollar limitations for benefits and contributions that apply to retirement plans.

Source: www.socialsecurity.org.bz

Source: www.socialsecurity.org.bz

2019 Contribution Reform Social Security Board, Belize, The oasdi tax rate for wages paid in 2024 is set by statute at 6.2 percent for employees and employers, each. Earn less and you’re taxed on.

For 2024, The Social Security Wage Cap Will Be $168,600, And Social Security And Supplemental Security Income (Ssi) Benefits Will Increase By 3.2 Percent.

There's no wage base limit for medicare.

In 2024, This Limit Rises To $168,600, Up From The 2023.

In 2024, that number is $168,600.